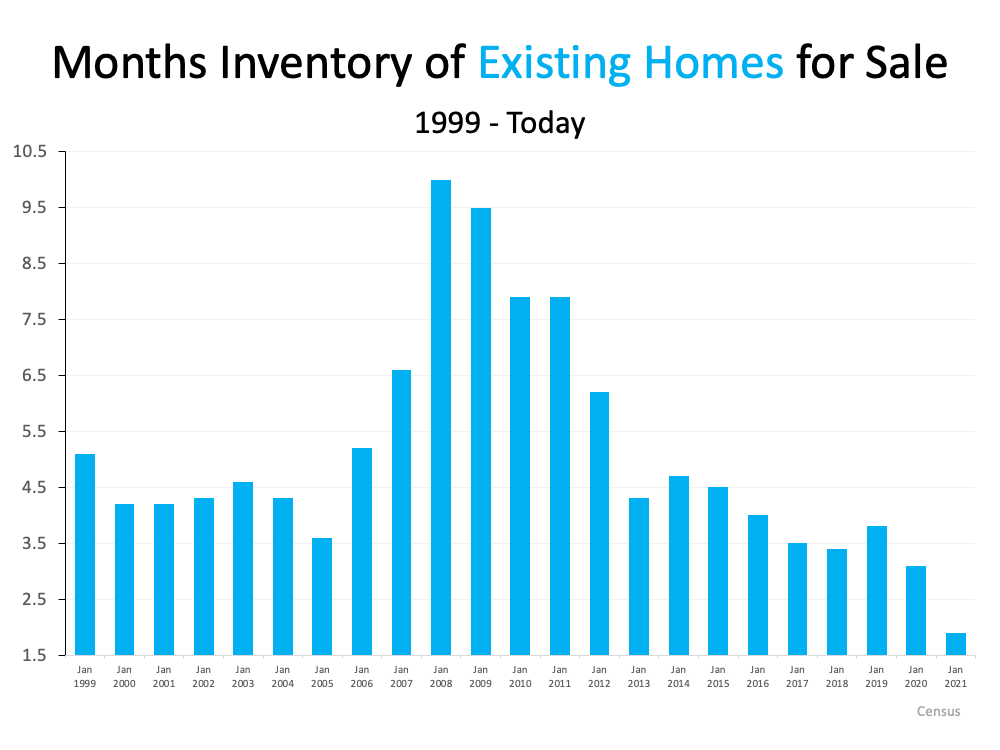

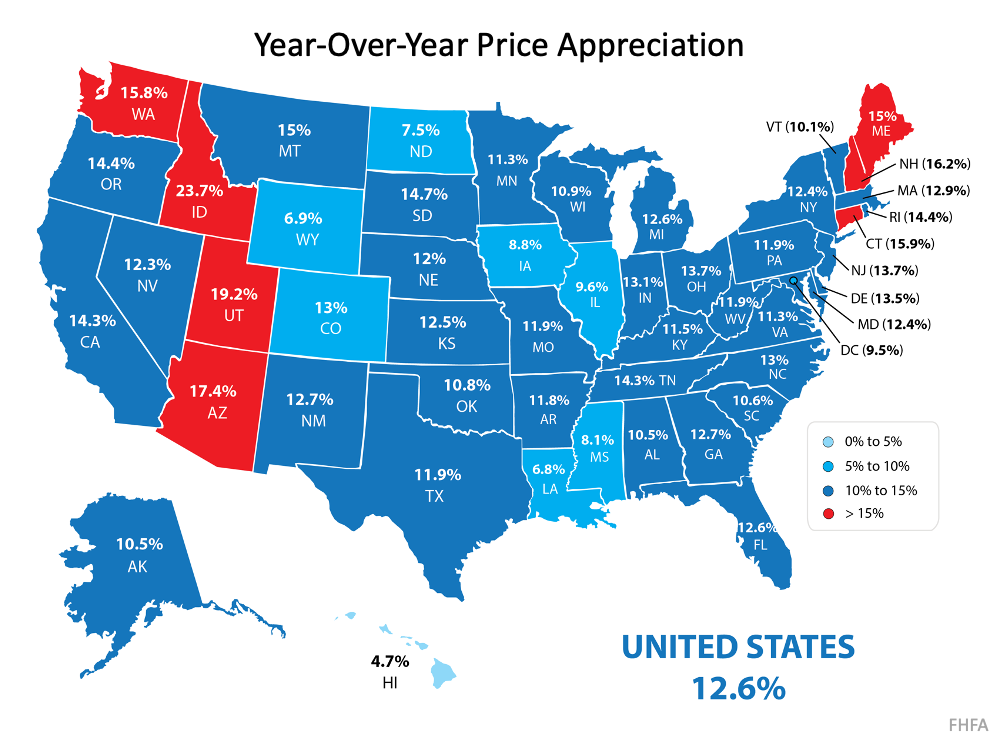

In the past year, home prices have exploded in many more places than during the housing bubble of the mid-2000s.

Is a Price Reprieve Coming?

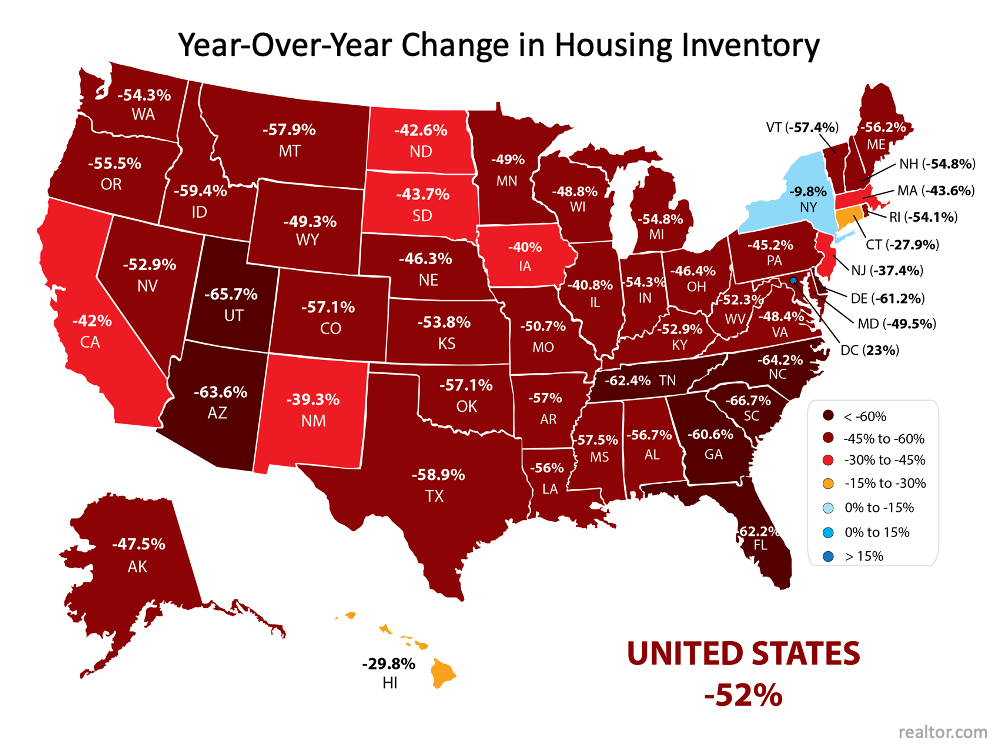

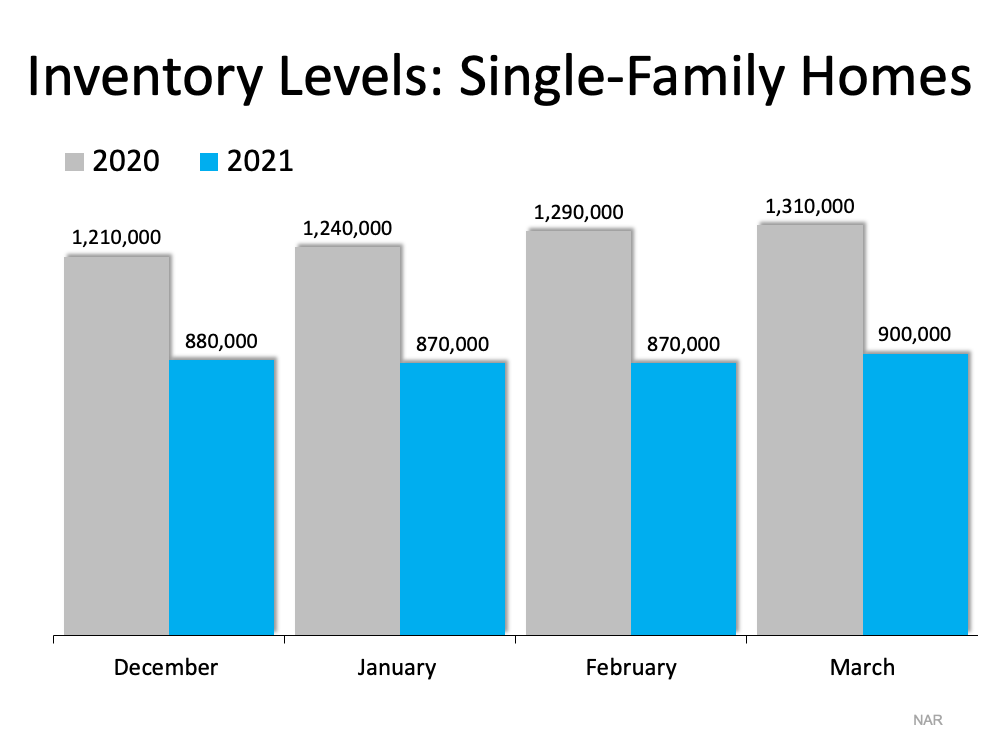

The short answer is probably not. Why? Because there are simply too many people with money to spend looking for too few homes.

The result? 80% of metro areas had price rises of more than 10% in 2021 alone.

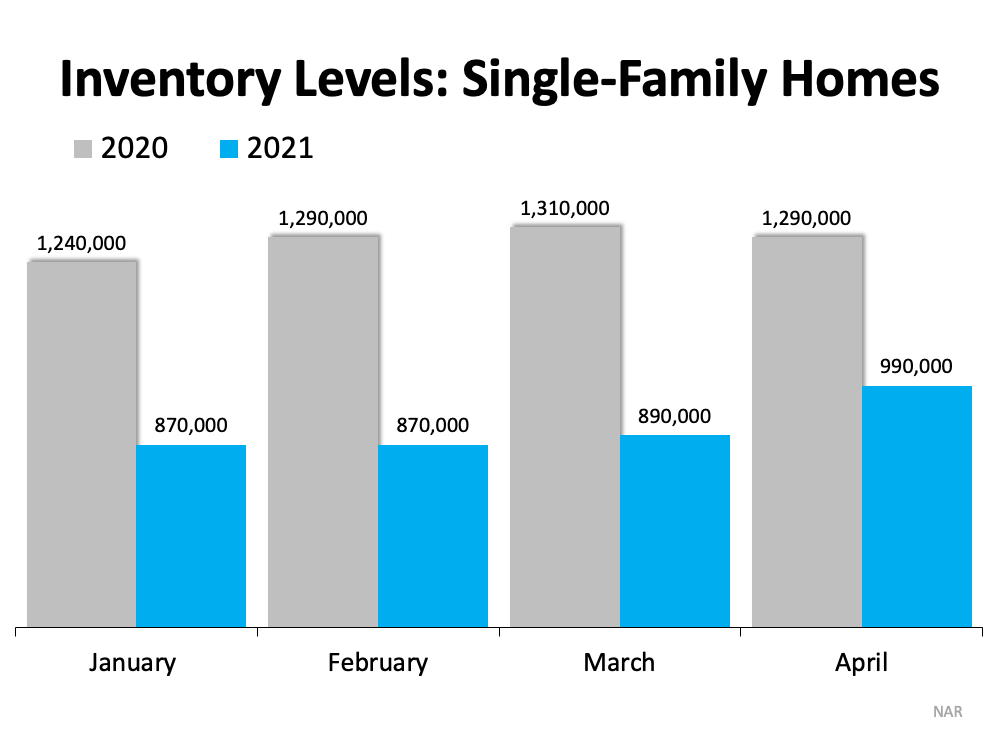

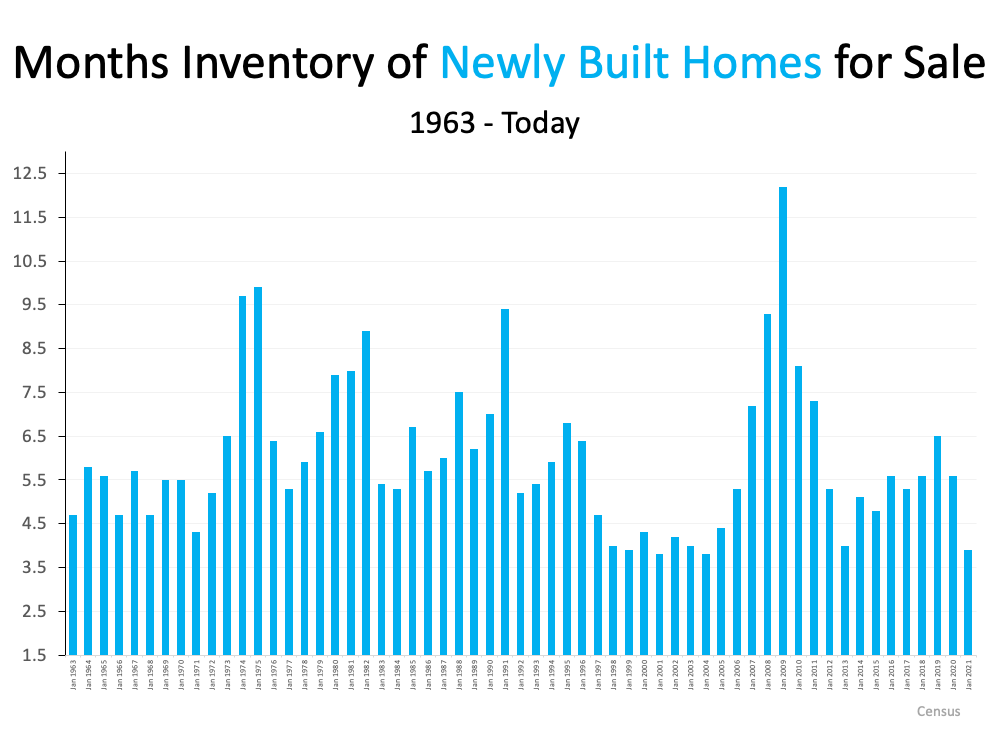

We’ve written a lot about how this imbalance between supply and demand has been a long time in the making. Rock-bottom interest rates during the pandemic have only exacerbated this imbalance.

Imbalance of Supply & Demand Requires Time to Resolve

Economists tell us that we need to build lots more housing. Even in the Southwest where many new housing units are being built, demand continues to overwhelm new supply and prices continue to soar.

Then, there are the immediate problems of supply chain delays that extend timelines for new construction completions and make materials/supply prices even higher for those new home completions. This chicken and egg scenario makes homebuyer prices even higher as builders “pass along” those higher materials/supply costs to the buyer. This cycle makes more houses unaffordable to many buyers from the perspectives of a down payment and monthly mortgage payments.

“Fixes” that take even longer than building new houses to kick up supply are changing local zoning requirements to amp up supply and making housing affordability a national priority.

True, there are a few locales around the country where zoning laws are opening up (Minneapolis, Portland OR, many places in Texas/Arizona) but the pervasive attitude about less restrictive zoning for new housing is NIMBY-ism or Not In My Back Yard.

It’s also highly unlikely that prioritizing housing affordability will happen any time soon, if at all. Policy makers are fully aware that houses are selling faster than ever so their thinking on the whole is, “why fix something that ain’t broken?”

After all, housing has been one of the major economic stalwarts throughout the pandemic and 2022 homebuying is already blazing.

Likely Scenarios for First-Time Homebuyers

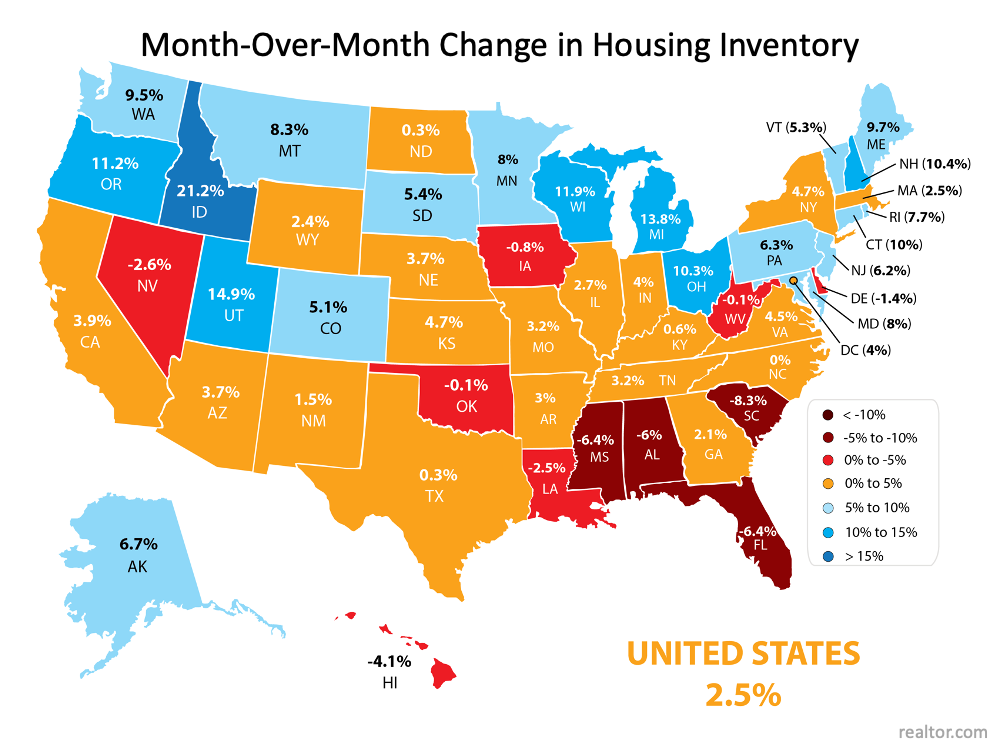

Experts are anticipating that home price gains may slow this year and into the next few years only if supply substantially improves. Simultaneously, experts anticipate that prices are unlikely to reverse. Add to these two factors the reality that mortgage interest rates are already climbing and will continue climbing as the Federal Reserve formally initiates rate increases Beginning in March.

45,368 total views, 8 views today